Property Tax Reduction Illinois . The first is available to all. If you qualify for an exemption,. The most significant is the. what is a property tax exemption? so how can you reduce your property tax burden? to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. A property tax exemption is like a discount applied to your eav. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. There are two primary methods. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most common is the. Pritzker friday signed legislation easing the tax burden for some of the. fulfilling a promise of offering property tax relief for illinoisans, gov.

from www.illinoispolicy.org

The most common is the. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. If you qualify for an exemption,. Pritzker friday signed legislation easing the tax burden for some of the. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most significant is the. There are two primary methods. A property tax exemption is like a discount applied to your eav. what is a property tax exemption?

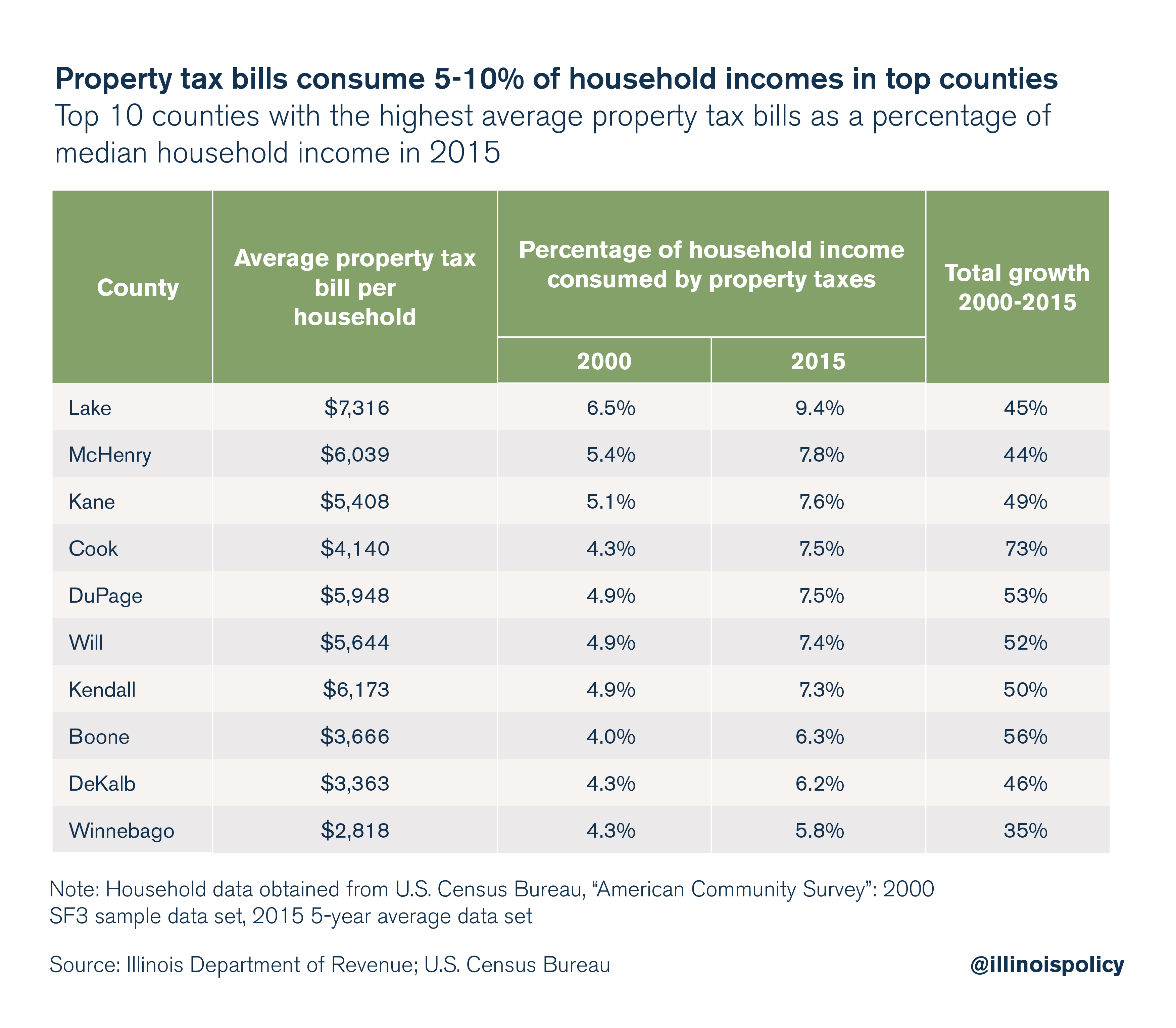

Property taxes grow faster than Illinoisans’ ability to pay for them

Property Tax Reduction Illinois so how can you reduce your property tax burden? what is a property tax exemption? If you qualify for an exemption,. Pritzker friday signed legislation easing the tax burden for some of the. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. fulfilling a promise of offering property tax relief for illinoisans, gov. The first is available to all. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. The most common is the. There are two primary methods. A property tax exemption is like a discount applied to your eav. The most significant is the. to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. so how can you reduce your property tax burden?

From taxleopard.com.au

10 Tips to Reduce Tax on Property TaxLeopard Property Tax Reduction Illinois A property tax exemption is like a discount applied to your eav. The most common is the. what is a property tax exemption? There are two primary methods. The first is available to all. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. Web. Property Tax Reduction Illinois.

From seniorsresourcecenter.com

Property Tax Reduction Seniors Resource Center Property Tax Reduction Illinois there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. The most common is the. There are two primary methods. Pritzker friday signed legislation easing the tax burden for some of the. so how can you reduce your property tax burden? The first is available to all. The most significant. Property Tax Reduction Illinois.

From www.slideshare.net

Property tax reduction and property tax appeal Property Tax Reduction Illinois The first is available to all. fulfilling a promise of offering property tax relief for illinoisans, gov. If you qualify for an exemption,. There are two primary methods. so how can you reduce your property tax burden? what is a property tax exemption? The most common is the. to be eligible, you must have paid illinois. Property Tax Reduction Illinois.

From www.illinoispolicy.org

Democrats’ fake property tax freeze won’t save Illinois’ underwater Property Tax Reduction Illinois A property tax exemption is like a discount applied to your eav. The first is available to all. to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. The most. Property Tax Reduction Illinois.

From issuu.com

Property Tax Reduction Rules and How You Can Save More by Cutmytaxes Property Tax Reduction Illinois there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. so how can you reduce your property tax burden? The most common is the. The first is available to all. If you qualify for an exemption,. A property tax exemption is like a discount applied to your eav. what. Property Tax Reduction Illinois.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Property Tax Reduction Illinois There are two primary methods. fulfilling a promise of offering property tax relief for illinoisans, gov. A property tax exemption is like a discount applied to your eav. The first is available to all. The most significant is the. If you qualify for an exemption,. so how can you reduce your property tax burden? the illinois property. Property Tax Reduction Illinois.

From www.youtube.com

Property Tax Reduction Changes _YouTube YouTube Property Tax Reduction Illinois The most significant is the. so how can you reduce your property tax burden? The most common is the. There are two primary methods. fulfilling a promise of offering property tax relief for illinoisans, gov. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. to be eligible,. Property Tax Reduction Illinois.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Property Tax Reduction Illinois property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. Pritzker friday signed legislation easing the tax burden for some of the. to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. fulfilling a promise of offering property tax relief for illinoisans, gov.. Property Tax Reduction Illinois.

From repweber.com

Meaningful, Substantive Property Tax Relief in Illinois is Critical Property Tax Reduction Illinois The first is available to all. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most significant is the. A property tax exemption is like a discount applied to your eav. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. to be. Property Tax Reduction Illinois.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 Property Tax Reduction Illinois to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. Pritzker friday signed legislation easing the tax burden for some of the. The most common is the. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property. Property Tax Reduction Illinois.

From printablerebateform.net

Illinois Property Tax Rebate Form 2023 Property Tax Reduction Illinois there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. fulfilling a promise of offering property tax relief for illinoisans, gov. so how can you reduce your property tax burden? property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. the illinois property. Property Tax Reduction Illinois.

From www.fresheconomicthinking.com

Property taxes reduce housing asset prices but don't make housing cheaper Property Tax Reduction Illinois the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. If you qualify for an exemption,. there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. property tax exemptions are savings that contribute to lowering a. Property Tax Reduction Illinois.

From abc7chicago.com

J.B. Pritzker criticized for property tax reduction ABC7 Chicago Property Tax Reduction Illinois The most common is the. If you qualify for an exemption,. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. to be eligible, you must have paid illinois property. Property Tax Reduction Illinois.

From www.lamansiondelasideas.com

This County to Cut Real Estate Taxes Amid Soaring Assessments Property Tax Reduction Illinois to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real. A property tax exemption is like a discount applied to your eav. there are. Property Tax Reduction Illinois.

From ptrcny.blogspot.com

Property Tax Reduction Consultants Property Tax Exemptions Who Property Tax Reduction Illinois The most significant is the. The most common is the. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. fulfilling a promise of offering property tax relief for illinoisans, gov. to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. Pritzker friday. Property Tax Reduction Illinois.

From seniorsresourcecenter.com

Property Tax Reduction Seniors Resource Center Property Tax Reduction Illinois to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. what is a property tax exemption? If you qualify for an exemption,. fulfilling a promise of offering property tax relief for illinoisans, gov. The first is available to all. The most common is the. There are two. Property Tax Reduction Illinois.

From patch.com

Last Chance to Appeal Your Lakeview Property Taxes Lakeview, IL Patch Property Tax Reduction Illinois so how can you reduce your property tax burden? There are two primary methods. to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. The first is available to all. the illinois property tax credit is a credit on your individual income tax return equal to 5. Property Tax Reduction Illinois.

From www.slideshare.net

Tips for property tax reduction Property Tax Reduction Illinois to be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross. so how can you reduce your property tax burden? there are a number of exemptions that can reduce assessed value (and therefore property tax payments) in illinois. Pritzker friday signed legislation easing the tax burden for some. Property Tax Reduction Illinois.